Mortgage Calculator Guide helps you estimate your monthly home loan payment, total interest, and overall mortgage cost before buying a house or property. A mortgage calculator is an essential tool for long-term financial planning and smart home-buying decisions.

This complete Mortgage Calculator guide explains how mortgage calculations work, how monthly payments are determined, and how you can use a mortgage calculator to compare loan options, interest rates, and repayment terms with confidence.

What Is a Mortgage Calculator?

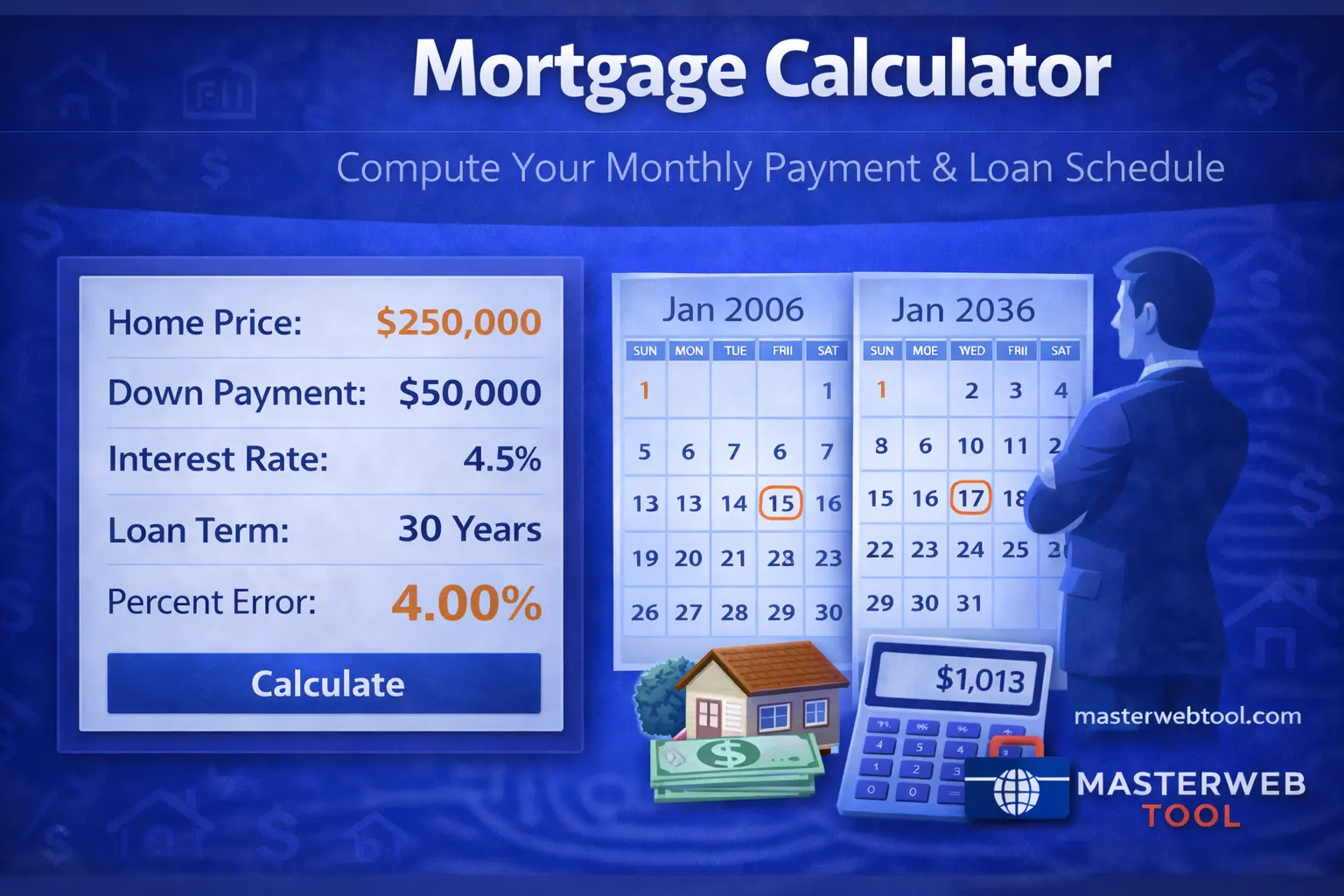

A Mortgage Calculator is an online tool that estimates your monthly mortgage payment based on home price, down payment, interest rate, loan term, and other factors such as property taxes or insurance (if included).

It helps home buyers understand affordability and long-term repayment commitments.

Why Mortgage Calculator Is Important

- Estimates monthly mortgage payments in advance

- Helps plan home-buying budget

- Shows total interest payable over loan life

- Allows comparison of loan terms

- Prevents financial overcommitment

How a Mortgage Calculator Works

A Mortgage Calculator uses a standard loan amortization formula to calculate monthly payments based on principal amount, interest rate, and loan duration. Some calculators also factor in taxes and insurance for a more realistic estimate.

Mortgage Payment Formula Explained

The standard mortgage payment formula is:

- EMI = [P × R × (1+R)N] ÷ [(1+R)N − 1]

Where:

- P = Loan principal

- R = Monthly interest rate

- N = Loan term (months)

How to Use a Mortgage Calculator (Step-by-Step)

- Enter the home purchase price

- Add your down payment amount

- Enter interest rate

- Select loan tenure (years)

- Click calculate to view results

Understanding Your Mortgage Results

The result shows your estimated monthly payment, total interest cost, and total amount paid over the life of the loan. Longer loan terms lower monthly payments but increase total interest.

Mortgage Calculator vs Loan Calculator

- Mortgage Calculator: Designed specifically for home loans

- Loan Calculator: Used for general loans

Mortgage calculators often include additional home-related costs.

Who Should Use a Mortgage Calculator?

- First-time home buyers

- Property investors

- Real estate planners

- Home loan applicants

- Financial advisors

Common Mistakes When Using a Mortgage Calculator

- Ignoring property taxes and insurance

- Entering incorrect interest rate

- Overlooking down payment impact

- Focusing only on monthly payment

Tips to Reduce Mortgage Cost

- Make a higher down payment

- Choose shorter loan tenure

- Compare mortgage interest rates

- Consider prepayment options

Related Financial Calculators

Calculate Your Mortgage Payment

Use our free Mortgage Calculator to plan your home loan wisely and understand your long-term financial commitment.

Open Mortgage Calculator →Frequently Asked Questions (FAQ)

What is a Mortgage Calculator?

A Mortgage Calculator estimates monthly home loan payments, interest, and total cost based on loan details.

Is a Mortgage Calculator accurate?

Yes, it provides accurate estimates using standard mortgage formulas, though actual lender terms may vary.

Can I include taxes and insurance?

Some mortgage calculators include taxes and insurance for more realistic payment estimates.

Is mortgage EMI fixed?

Mortgage EMI can be fixed or variable depending on loan type and interest structure.