FD Calculator Guide helps you estimate the maturity amount and interest earned on a Fixed Deposit (FD). Fixed Deposits are among the most popular and safest investment options, especially for risk-averse investors who want guaranteed returns.

This complete FD Calculator guide explains how fixed deposits work, how interest is calculated, why an FD calculator is useful, and how you can use it to compare different FD tenures and rates before investing.

What Is a Fixed Deposit (FD)?

A Fixed Deposit is an investment option where you deposit a lump sum amount with a bank or financial institution for a fixed period at a predetermined interest rate. At maturity, you receive the principal plus interest.

FDs offer stable returns and are considered low-risk investments.

What Is an FD Calculator?

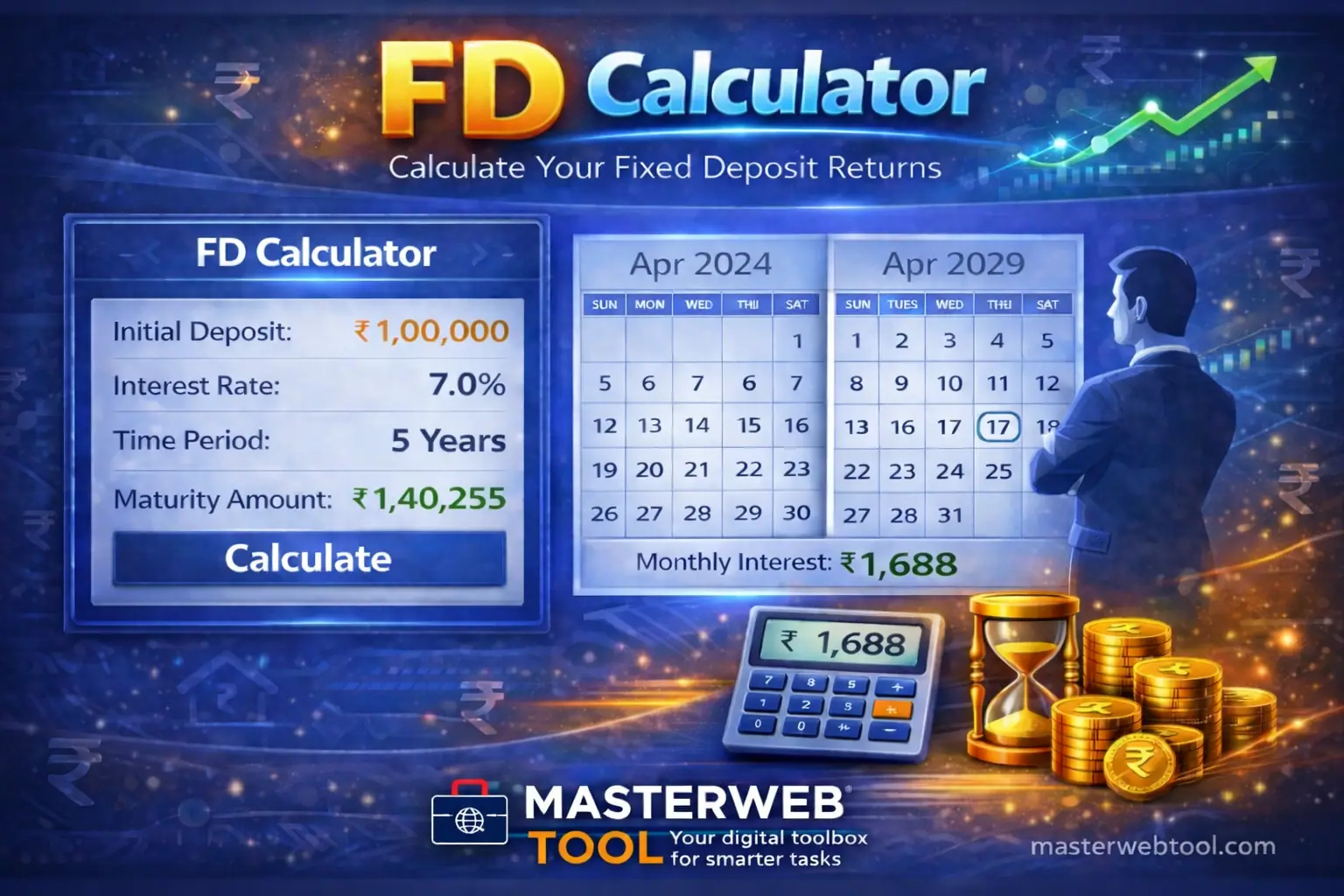

An FD Calculator is an online financial tool that calculates the maturity amount and total interest earned on a fixed deposit based on deposit amount, interest rate, tenure, and compounding frequency.

Why FD Calculator Is Important

- Calculates FD maturity amount instantly

- Shows total interest earned

- Helps compare different FD tenures

- Assists in financial planning

- Eliminates manual calculation errors

How an FD Calculator Works

An FD Calculator works by applying compound interest formulas to your deposit amount using the selected interest rate and tenure. You simply enter the required values and the calculator shows accurate results instantly.

FD Interest Calculation Formula

The compound interest formula used for FD calculation is:

- A = P × (1 + r/n)n×t

Where:

- P = Principal amount

- r = Annual interest rate

- n = Compounding frequency

- t = Time (years)

How to Use an FD Calculator (Step-by-Step)

- Enter the deposit amount

- Select the interest rate

- Choose the FD tenure

- Select compounding frequency

- Click calculate to view maturity value

Understanding Your FD Calculator Result

The result shows the maturity amount and interest earned. Longer tenure and higher interest rates lead to higher returns, but liquidity may be limited during the FD period.

Types of Fixed Deposits

- Regular Fixed Deposit

- Senior Citizen FD

- Tax-Saving FD

- Corporate FD

FD Calculator vs Manual Calculation

- FD Calculator: Fast, accurate, and convenient

- Manual Calculation: Time-consuming and error-prone

Using an FD calculator simplifies investment planning and ensures accuracy.

Who Should Use an FD Calculator?

- First-time investors

- Senior citizens

- Risk-averse investors

- People planning guaranteed returns

- Anyone comparing FD options

Common Mistakes While Using FD Calculator

- Ignoring compounding frequency

- Entering incorrect interest rate

- Overlooking tax implications

- Comparing FDs without tenure alignment

Tips to Maximize FD Returns

- Choose higher interest tenures

- Consider senior citizen FD benefits

- Compare rates across banks

- Reinvest maturity amount wisely

Related Financial Calculators

Calculate Your FD Maturity Amount

Use our free FD Calculator to plan your fixed deposit investment and estimate guaranteed returns with ease.

Open FD Calculator →Frequently Asked Questions (FAQ)

What is an FD Calculator?

An FD Calculator is an online tool that calculates the maturity amount and interest earned on a fixed deposit.

Is FD Calculator accurate?

Yes, it uses standard compound interest formulas and provides accurate estimates.

Can FD Calculator calculate tax?

Most FD calculators do not include tax. Tax depends on applicable income tax rules.

Is FD a safe investment?

FDs are considered low-risk investments, especially when placed with reputed banks.